Tax Savings in Commercial Property - Bhutani Group

Real estate investment has always existed in India. Since the past decade commercial real estate investment has become so popular in the country, especially in Tier-I markets like Delhi/NCR, Mumbai, Bengaluru, and

Pune.

The tax laws in India are also designed to offer relief to homebuyers but when it comes to commercial real estate, a lot of people do not know much about the taxation around it.

You can save tax on commercial property investment as well. So, let us talk about the tax rules and regulations for commercial property investors.

Taxes on Rental Income from Commercial Property

A lot of investors buy commercial properties to rent them out so that they can earn regular rental income from them.

Rental income from any type of property- whether the residential or commercial property is categorized under the head's income from house property.

However, if you do not own the said property and are under a sublease agreement, then it will be counted under the category of income from other sources.

Tax on rental income is calculated on the basis of two main values:

-- The actual rent received by you

-- Deemed Rent of the property as per Municipal Valuation

The higher of these two will be considered for the purpose of tax calculation.

You should note that a standard deduction of 30% of the rental income is offered to you straight away.

In addition to this, you can avail of a deduction under Section 24(b) to cover the interest paid on a loan that you may have taken for the construction, extension, repair, or reconstruction of your commercial property.

A lot of people think that this deduction is allowed only on residential property, but it can also be availed on your let-out commercial property. For further inquiries, you must contact the best commercial developers in India.

Taxes on Commercial Property used for Your Own Business or Profession

When you have bought a commercial property and are using it fully or partially for the purpose of your own business or profession, such a portion of the property will not come into your tax purview as an individual but will be counted in the business’s taxation.

Here, you can set off the amount spent on the repair and maintenance of the property against your business income.

Remember that the deduction for the home loan principal amount under Section 80C of the Income Tax Act is not applicable to commercial projects. Only residential properties are eligible for this deduction.

Taxes on Profits Earned when You Sell a Commercial Property

When you own a commercial property that you are using for your business/professional purposes, and you sell such property, the profits arising out of this will be considered short-term capital gains.

You can save this tax burden by investing the net consideration of such a sale in residential property and getting a deduction under Section 54F.

Such residential property should be held for more than 24 months. There are certain institutions that issue capital gain bonds; you can invest this profit in such capital gain bonds in order to avail of a deduction under Section 54EC of the Income Tax Act.

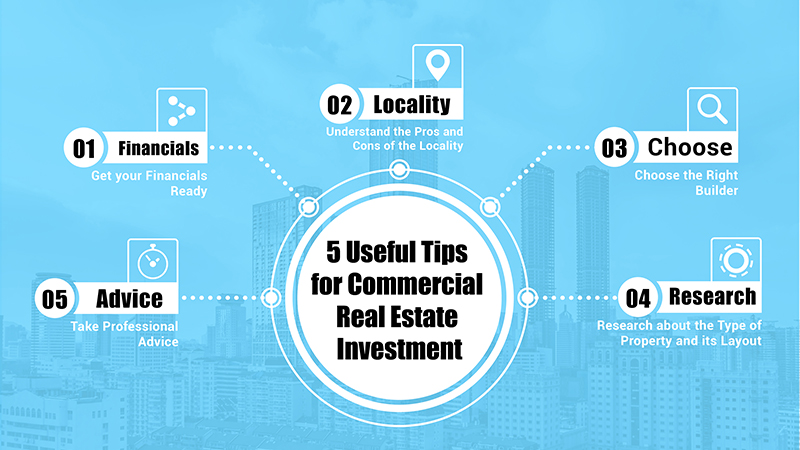

Shown above were the three major categories under which you may wonder about tax liability. It is true that the tax benefits are higher on a residential property but by having a smart approach toward taxation and making the right investments at the right time, you can save taxes on your commercial properties in Noida.

Leave a comment

All fields marked with an asterisk (*) are required