Commercial Property Investment Tips for Effective ROI

Since 2016 there has been a steadier uptake in commercial real estate purchases in comparison to real estate counterparts. The IT-ITeS sectors and the banking and finance services sector continue to influence the demographic for commercial land.

At the present, the market is teeming with tech start-ups and e-commerce buyers who are looking for high-quality office space in Mumbai, Delhi-NCR, Pune, Bengaluru, Hyderabad, and Chennai.

However, the demand is not met with the required rate of supply, and this has been the trend for a good 2-3 years now.

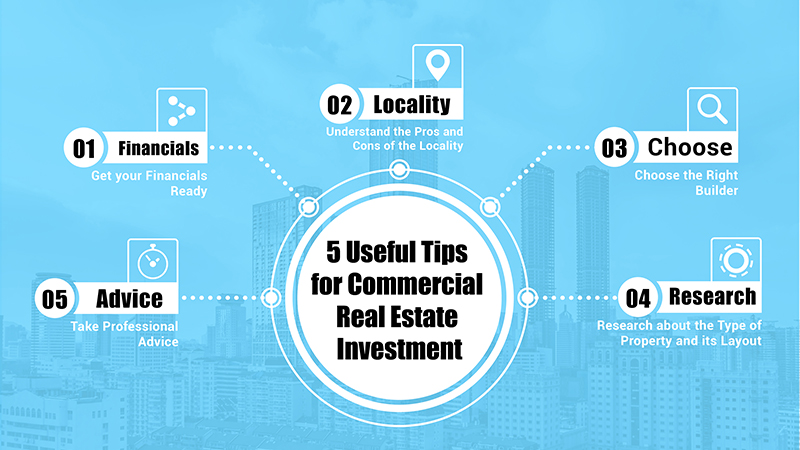

Profitable Commercial Property Investment Tips

This opens up a lucrative market for property owners who are in the business of lending space. It is more profitable to lease office space now rather than residential real estate.

The yield is 8-10% high annually when it comes to commercial real estate. The annual yield from residential spaces is an unattractive 2-3% in comparison. This is not to mention the standard deduction of 30% on the rental that real estate owners usually have to bear in the form of repair and maintenance.

Office leases are thus more profitable in comparison. One can even hike the rate by 5-10% every year.

Risks Involved

There are certain risks involved in the process depending on which stage of property development you are investing in.

Investment in commercial property in the construction stage or in the constructed but yet to be let, or even a property that has finished development and has been leased out any of these stages come with their own sets of risks.

The highest risk and payout are both a characteristic of the under-construction stage. The safest is to invest in one which is developed and already let.

Buying commercial property for investment is risky if the tenant is at the end of a lease. If there is an economic downturn the property may sit vacant and unyielding for a while.

Questionable Elements in the Commercial Real Estate Market

Commercial property investment tips are also supposed to safeguard the buyer from the questionable schemes which usually come along with tags like ‘assured returns. Firstly, the builder usually charges you for the ‘assured’ safeword. The price will be evidently more than similar buildings in the same location.

Secondly, there is no guarantee that a tenant will occupy the building immediately after completion, which means delayed rent. If the developer controls the tenant there is a delay in the payment of the so-called assured returns.

These types of schemes are not advisable for investing in commercial real estate for beginners as they usually bring along buildings that are usually plagued by a soft launch.

Being Sanguine with the Fine Print

One of the best commercial property buying tips that you can get is that it is always safe to bet on a unit located in an economically vibrant area. This way there is some assurance of drumming up business by the time the building is constructed. However, the best commercial property investments are the ones made in locations where the demand is NOT met with equivalent supply.

If you are looking for the best developer in India then get in contact with Bhutani Infra.

Leave a comment

All fields marked with an asterisk (*) are required